At 12:30pm today (November 26), Chancellor Rachel Reeves announced the Autumn Budget 2025 which had farmers on the edge of their seats waiting to see what she has in store for the industry.

Many urged the Government to raise the Inheritance Tax threshold which currently sits at £1 million, so that smaller farms will not be impacted. Ministers have said, however, that no APR and BPR changes will be made, and at the recent CLA conference Farming Minister Dame Angela Eagle said, ‘we are where we are on that one and we have got to look forward', and the industry must move on.

Now farmers gather outside Westminster.

READ MORE: What can farmers expect from the Autumn Budget 2025?

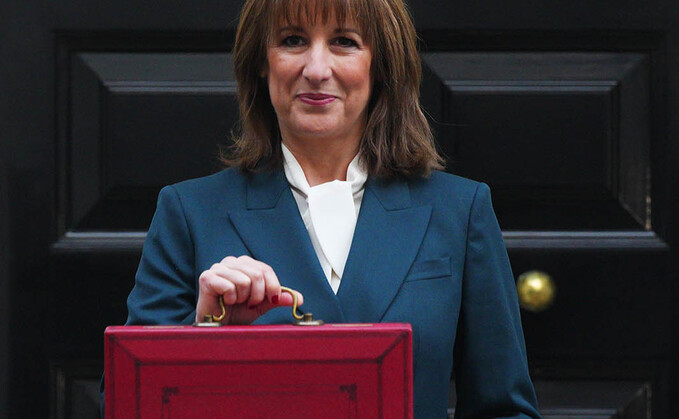

The Chancellor has left Downing Street with her red box. She will now make her way to the House of Commons, where she will deliver the Budget.

During her departer, farmers gathered to boo her and sound their horns.

View this post on Instagram

During Prime Ministers Questions (PMQ's), opposition leader Kemi Badenoch criticises the decision's of Rachel Reeves by pointing out the farmers protests outside.

The Chancellor's mention of changes to Inheritance Tax made in the previous years Budget ignited jeers across the House of Commons.

Simon Gooderham, managing partner, Cheffins comments: "It is a major disappointment that the Government has not made a U-turn on, or even softened, its latest announcement this afternoon regarding Inheritance Tax and in particular, Agricultural Property Relief.

"The financial and mental strain on the agricultural sector has been immense, with the combination of the tapering out of the Basic Payment Scheme and the dwindling numbers of farm subsidies and environmental grants.

"The £1m cap on relief has created worrying times for the entire agricultural community, and as a result, it is anticipated that more farmland will be offered for sale as farmers try to offset individual tax liabilities.

"This aggressive policy approach by the Government to IHT will likely mean that a number of active farms will be swallowed up within the next generation, creating a bleak future for many family farms and rural communities across the country.

"Forward planning with appropriate professional advice and support At will be critical to help farmers navigate their way through this disastrous policy."

In England properties worth more than £2m will face a £2,500 annual charge, rising to £7,500 for properties worth more than £5m.

Basic rate of Income Tax or National Insurance will not increase.

RPI inflation increase to alcohol duty.

The Scotch Whisky Association (SWA) has responded to the Chancellor's decision to further increase duty on Scotch Whisky, saying that it will put 'additional pressure on a sector suffering job losses, stalled investment and business closures'.

Mark Kent, chief executive of the SWA said: "The Scotch Whisky industry is disappointed that the domestic tax burden has once again increased in the Autumn Budget, putting huge additional pressure on a sector suffering job losses, stalled investment and business closures.

"Put simply, the government cannot expect the Scotch Whisky sector to just keep delivering growth, both at home and on the world stage, if the conditions which support growth are not nurtured.

"The previous 3.65% increase to spirits duty has reduced spirits revenue by 7% - a loss to the Treasury of £150m. Hiking duty today, for the third time in two years, not only limits our sector's ability to contribute to much needed economic growth and productivity, but will once again fail to deliver for the public purse and needlessly cost jobs.

"Increasing global and domestic pressures led our industry to ask for duty in our home market to remain unchanged. Not a tax cut, not a handout, simply breathing room for a critical Scottish industry. Government has chosen to ignore those warnings, to the detriment of distillers, of bars and restaurants, our farmers and suppliers, and ultimately of growth."

Scottish Conservative MP for Gordon and Buchan Harriet Cross joined farmers on the streets of London ahead of the Budget announcement to underline the damage that has already been caused by the tax rise.

"This is yet another dark day for the farming industry who are being put through hell by this Labour government," she said.

"Rachel Reeves had the chance to fix the damage that Labour have caused, but instead she has sold out the industry which could signal the end for rural businesses.

"The Chancellor's decision not to axe this tax will change the future of family farming forever – not for the better – but for worse.

"The industry is contending with one of its toughest periods in living memory, and next April will make survival even harder.

"Rachel Reeves should be ashamed of her decision to use farmers as a pawn to claw back money for her mistakes."

Opposition Leader Kemi Badenoch responds to the Chancellors Budget.

Ms Badenoch says Ms Reeves should be on the side of the farmer 'like the Conservatives are'.

Tenant Farmers Association (TFA) chief executive George Dunn said: "We welcome the concession announced in today's Budget that the new £1 million zero rate threshold for Agricultural and Business Property Relief from Inheritance Tax to be introduced from next April will be transferable between spouses and civil partners.

"However, that is only one of six reasonable asks tabled by the Tenant Farmers Association to the Inheritance Tax changes she announced in 2024.

"It is hugely frustrating that the Chancellor did not engage with the farming community to debate her policies and to take account of the full package of measures that would both enhance the ability of the Government to meet its public policy objectives and diminish the damaging impacts on farm businesses and farm families.

"Sadly, the Chancellor has run scared from meeting farmers and their representative bodies to debate her policies, and she continues to block that engagement.

"At the same time as farmers were being arrested for peacefully protesting against her taxation changes, just a stone's throw from Parliament, her failure to adequately address their legitimate concerns in her Budget statement is lamentable.

"The Chancellor has one further opportunity to redeem herself by comprehensively amending the draft Finance Bill legislation before she tables it for debate in Parliament and I strenuously urge her to take it.

"Additionally, it is hugely disappointing that we have not seen any movement on the operation of Stamp Duty Land Tax as it impacts much needed longer-term tenancies nor on the rules around Universal Credit which discriminates against farmers who work long hours for low returns.

"Farmers and farm families will, once again, feel largely unheard and misunderstood by this Chancellor of the Exchequer and the TFA will be continuing to lobby for that to change."