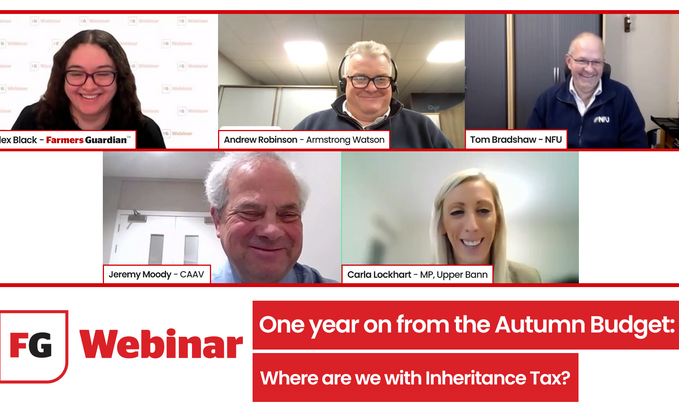

Hosted by Farmers Guardian, this webinar discussed the changes to Inheritance Tax (IHT) announced in the Autumn 2024 Budget, where the industry currently stands and answer questions on what actions farmers should be taking ahead of April 2026.

WATCH THE FULL WEBINAR:

Expert panel:

Tom Bradshaw, NFU president

NFU president Tom Bradshaw joined the panel, giving insight into the NFU's long battle with Government to change the Inheritance Tax policy. The organisation's 'Stop the family farm tax' campaign urges the Labour Government to rethink the impact IHT will have on family farms as well as food security.

Carla Lockhart, MP for Upper Bann in Northern Ireland and DUP Agriculture Spokesperson

This week, Ms Lockhart brought forward a debate in Parliament's Westminster Hall, outlining that the proposed changes, set to be implemented in April 2026, will have devastating consequences for family farms across the UK. She has called on the Government to listen, rethink, and stand with family farmers before it's too late.

Jeremy Moody, CAAV

Secretary and adviser to the Central Association of Agricultural Valuers (CAAV) since 1995, Jeremy liaises with Government on new policies developing across the UK, covering agricultural tenancy and land occupation, taxation, valuation, planning, climate change and environmental matters. He is currently involved in analysis of the effects of the Chancellor's IHT proposals across the UK.

Andrew Robinson, Armstrong Watson

Andrew is an accounting partner at Armstrong Watson who grew up on a large hill farm in North Cumbria and still has an active role on a large beef farm in Northumberland. This gives him a great insight into the issues affecting farmers in their businesses and helps inform his day-to-day work supporting and advising farming businesses and landed estates, particularly on succession and IHT matters.